Marcel LUX III SARL (Marcel) as the largest shareholder in SUSE is planning to take the company private and delist it from the Frankfurt Stock Exchange. SUSE will be merged with an unlisted Luxembourg entity. Marcel currently owns a 79% stake in SUSE.

If they’re public, they have huge pressure. If not, they can play their own game with a specific strategy that a shareholder might not like. So this could well be a good thing. Public trading usually leads to enshitification.

Marcel LUX III SARL

Company wholly owned by the EQT group, a publicly traded global investment organization. This is just going to lead to more enshittification.

If they own 79%, Marcel can already make it do what they want.

But you are still obligated to always act in the best interest of the shareholders. Private means you don’t answer to anyone outside the company and are not forced to do everything to pump the stock price every quarter.

For all practical purposes Marcel was the only shareholder anyway.

That being the reason why valve are able to produce quality over quantity

Used to think the same about LTT though

I wonder what would that mean for openSUSE, given that, apparently, an equity firm is making decisions on behalf of the SUSE board 😞

I know nothing about this firm and the suse board (that seems to agree with the plan) but normally is great for companies to not be listed in stock market, usually the market put much pressure in short term profit and does not care about long term sustainability.

It’s private equity. Assume it’s going to involve bending over with no lube and a lot of lawyers.

Username checks out

Choo choooo all aboard the Enshittification Express

A bit of a shame because i’ve been eyeing a few Rolling Release distros to move to.

Edit: typo

There’s really no reason not to check out OpenSUSE, if you wanted to. If it does go down the enshittification path, it’ll no doubt be forked, given how relatively popular it is.

This move isn’t anything new by the way - SUSE was only public for two years, and was a private entity prior to that. If you’re worried about enshittification, you should’ve worried about it back when it was acquired by Novell, in 2003. Everyone said SUSE was doomed, but it continued on without any issues. SUSE changed ownership thrice since then, and yet it still stands strong, even two decades after Novell’s acquisition. So I expect this move won’t change anything, at least in the short term.

Of course they weren’t doomed during the Novell era, when they helped MS screw over the entire Linux community, and they sold Linux licences to MS that MS would sell to their customers as security that they won’t sue them for using Linux and therefore infringing on MS’s patents.

That’s reassuring, never knew about OpenSUSE’s aquisition history. Thanks for the info 👌

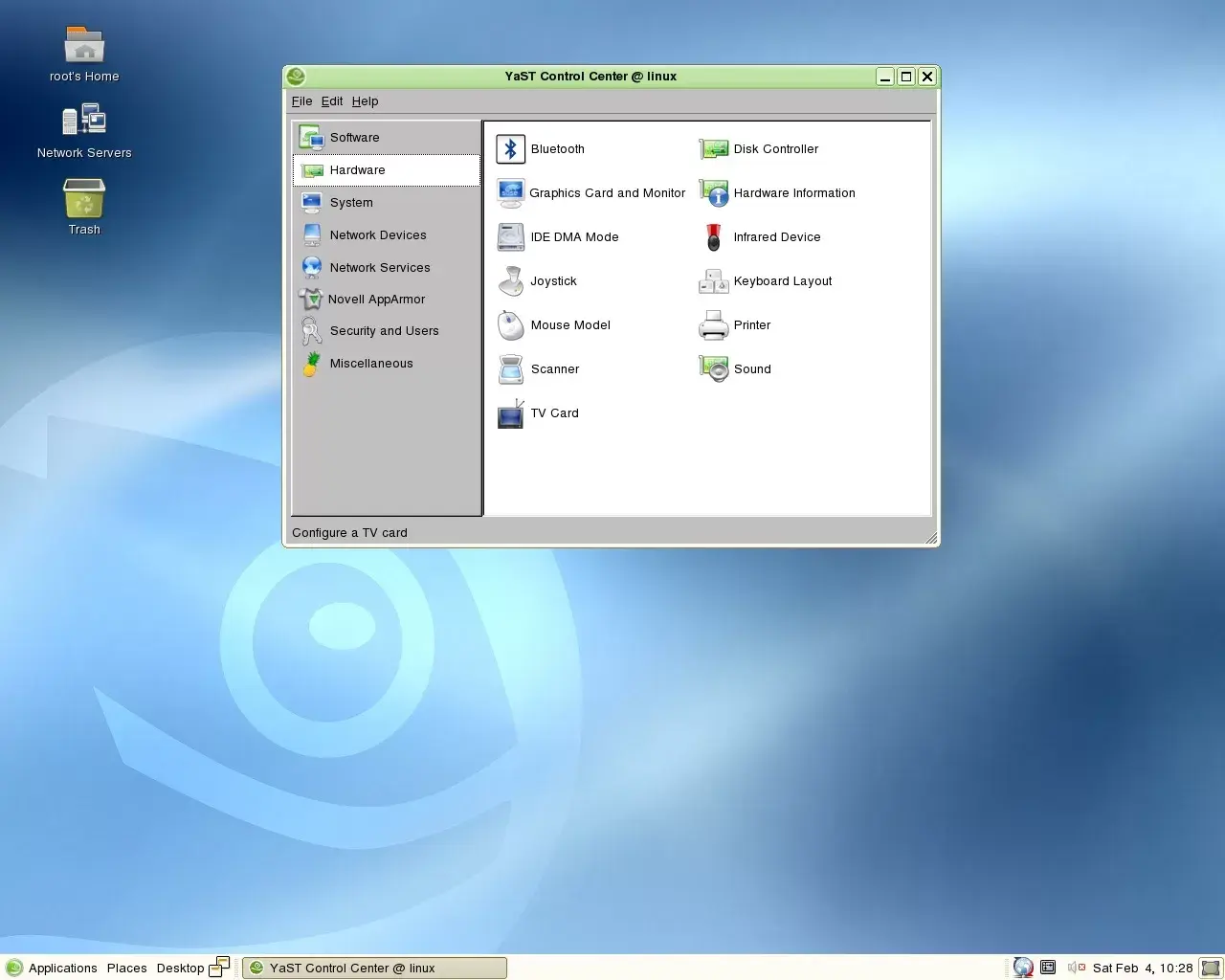

I checked out Leap a while back and was really impressed with how well thought out everything is, especially the control panel (I think it was called Yast?)

Debian calmly sipping tea in the corner

That’s a good question, and who is the mysterious 3rd party SUSE is going to be merged with?

Debian is looking better and better everyday.

Debian is looking better and better everyday.

No, don’t jinx it.

Too late. Already had to deploy GitLab on it.

I wonder what would that mean for openSUSE

Nothing. The oS maintainers put safeguards in place. At worst they would need to come up with a new name because of trademarks. openSUSE is sponsored by other companies than just SUSE. That doesn’t go just away.

Hopefully nothing too drastic, but also according to the article they were only publicly traded from 2021 to now, so for most of their existence they were in private hands anyway, albeit being passed around a fair bit.

I missed the point wrt 2021. That’s somehow comforting/reassuring. Thanks.

SUSE was already private under an equity firm until 2021 (EQT). Probably fine.

From what I’ve read this Marcel LUX III SARL company is also just a holding company under EQT. So nothing major has changed there.

This is the best summary I could come up with:

The SUSE organization has changed hands many times over the years… From being its own independent company to the notable acquisition by Novell two decades ago.

Over the past decade SUSE has changed hands between Attachmate, Micro Focus, EQT Partners, and then went public back in 2021 on the Frankfurt Stock Exchange.

Marcel LUX III SARL (Marcel) as the largest shareholder in SUSE is planning to take the company private and delist it from the Frankfurt Stock Exchange.

In taking SUSE private, the EQT Private Equity / Marcel is offering a ~16 EUR per share price, around a 67% premium over today’s share price.

"SUSE’s Management Board and Supervisory Board support the strategic opportunity from delisting of the company as it will allow SUSE to focus fully on its operational priorities and execution of its long-term strategy.

The interim dividend will be paid to all shareholders prior to the settlement of the Offer and will allow Marcel to finance its purchase of SUSE shares under the Offer and certain transaction costs incurred by it."

I’m a bot and I’m open source!

Good bot!

Also, I’d argue this is a good step forward for Suse, as it will take a lot of shareholder pressure off of them.

It doesn’t make automatically a good news, for example there’s a billionaire who took private ownership of an once famous social network and ran it to the ground completely annihilating its purpose

X-Bird: Nazi Chirpin’

Huh, this could be a good thing, stop them from being a target for shorts and free them from the typical pattern. But now it totally depends on whether the private owners suck or not. Let’s hope for the best!

That’s fantastic. That means they’ll focus more on quality, not just profit for the blackholes, I mean shareholders. I don’t use suse, but I’m very happy this is happening.

Let’s remember a time when Suse was owned by Nowell. Suse “admited” to Linux infringing on Microsoft’s patents in order to screw over redhat, and that allowed MS to continuously harras the entire Linux community for like a decade.

Doubt.

You’re free to.

Coincidentally I looked up whether they were private 30 minutes ago. Being a publicly traded company puts the focus on short term profit, the same issues Redhat is having with IBM. It might not help if the equity still wants that, but I’m hoping they won’t.

Thankfully as only 30% of the other investors have that option, it appears the controlling entity can let them sell their shares if they want out in the direction the company is going

I can’t decide if this will be a good idea or not

I would be cautiously optimistic. If they are public, the the top tier entity is the shareholders which usually don’t look further then their dividends and so public company usually focuses on short term growth. Public company doesn’t need to bend backwards towards committee of millions of shareholders and can focus on long term as it wants and deems fit, usually preferring long term investment. Of course it can go the other way too. When they are not responsible to shareholders, theres a possibility that the it gets squeezed end enshitified waaaay faster.

I mean I don’t think it’s the same as red hat at all because they are not making it closed source.

This is good news 😀. It’s always better to have a privately owned firm where there is no pressure to contrastingly make more money every year. They’ll be able to focus on providing the best systems and support rather than how much money they can make for the shareholders. 👍

deleted by creator

Whelp… Better cross SUSE off…

Why? Why is it bad that SUSE is private?

When Suse was privately owned by Nowell they helped Microsoft screw over the entire Linux community for over a decade.

The past doesn’t necessarily dictate the future. If the people in charge of SUSE’s direction going forward think way differently than the one’s back in regards to your comment, then the outcome can be different / better for the Linux community, can’t it?

deleted by creator

For sure, I’m just giving it as a counter to most people in the thread thinking privately owned must be better than publicly.

Well, there’s always the devil you know… (Ubuntu)

Debian for the win! Still kicking after 30 years!

The Grim Distro Reaper has been busy this year.

Debian for the win, baby! It’s been standing for 30 years and still kicking! Back, Grim Distro Realer!

Please, also don’t jinx it…

I view the Grim Distro Reaper as someone trying to fight a hydra. If you don’t cut off all the heads/forks/derivatives at once, you truly haven’t killed it.

deleted by creator

Canonical

Looking pretty good right now among the corporate distro makers. 🥲

Canonical

Looking pretty good right now among the corporate distro makers. 🥲

Yeah, sure… https://lwn.net/Articles/937369/

Do you consider this comparable to the harm IBM (RedHat) is causing?

Do you consider this comparable to the harm IBM (RedHat) is causing?

Compared to all the shit Canonical is pulling since such a long time, what IBM/RH is doing is child’s play:

- Claiming copyright on all free software binaries in Ubuntu, even those from GPL’ed source code and telling Linux Mint they need to get a license from Canonical: https://blogs.kde.org/2014/02/14/no-licence-needed-kubuntu-derivative-distributions (later changed after pressure, now all Ubuntu binaries except the GPL’ed ones require a license from Canonical: https://www.fsf.org/news/canonical-updated-licensing-terms)

- Canonical forcing out the Kubuntu maintainers for making aforementioned factually correct statements (this led to the creation of KDE Neon): https://www.pcworld.com/article/424171/kubuntus-founder-resigns-accuses-canonical-of-defrauding-donors-and-violating-copyright.html

- CLA’ed software which allows Canonical exclusively to sell proprietary versions: https://mjg59.dreamwidth.org/25376.html

- Mir (CLA’ed)

- Snap (CLA’ed)

- “Ubuntu is not a democracy”: http://www.webupd8.org/2010/03/ubuntu-is-not-democratic.html

- Buying votes on Debian CTTE to get Debian to adopt Upstart (CLA’ed) over systemd: https://www.phoronix.com/news/MTQ5NzQ

- Canonical closing doors on LXD: https://lwn.net/Articles/937369/

- …

This is exactly why I have never touched Ubuntu and avoid anything to do with Canonical as much as possible.

That’s interesting. I’m aware of all of these occasions and more but my take on the whole is the opposite. 😃

I’m aware of all of these occasions and more but my take on the whole is the opposite. 😃

So illegally claiming copyright on GPL’ed binaries is good? OK, that’s certainly one odd opinion to have…

Gross, gross, grrooossssss!

I mean, Canonical is also privately held and not publicly listed. And it looks like this is the same private equity firm that owned SUSE fully before taking them public. (Marcel LUX III SARL is a holding company owned by EQT Private Equity.)

Canonical is also privately held and not publicly listed.

For sure. The difference is in who the owner is and what their track record in regards to FOSS is. Putting the 19 years of BDFL’s Canonical ownership together, I think he’s generally been okay. The core products have always been open source and free for both commercial and non-commercial use. I don’t know much about the private equity firm currently holding SUSE.

And it looks like this is the same private equity firm that owned SUSE fully before taking them public. (Marcel LUX III SARL is a holding company owned by EQT Private Equity.)

I guess that’s a positive, but we really don’t know what direction they’d take once the curtains close. Chances are profit maximization will be at the top of the list. It’s unknown how that will translate in reality in the short and long term. E.g. would they be nice and give stuff for free early to steal customers from RHEL, tightening down the road, or cutting costs today to make a buck now. It’s anyone’s guess.

| the core products have been open source

They have been pushing more of the distribution into their proprietary app store format despite what the community says about it

At least Fedora and Flatpak does better…